Archive for category Interviews with Users or Focus Groups

Survey Results – Sami

Posted by Samantha Kanza in Interviews with Users or Focus Groups on April 14, 2014

51 people answered our survey and this blog details the results:

Results

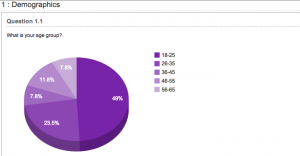

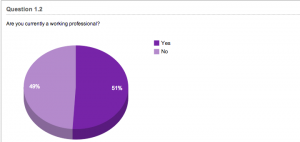

1. Demographics

This section showed that nearly 50% of our participants were in the 18-25 age group, and that there was a pretty even split between those who are working professionals or not.

2. Working Professionals

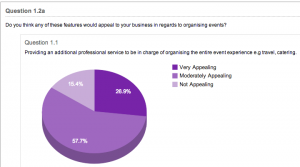

Out of those who are working professionals, 84.6% found the idea of a professional service to organise professional events appealing.

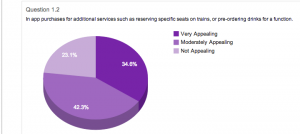

Out of those who are working professionals, 74.9% found the idea of in app purchases appealing.

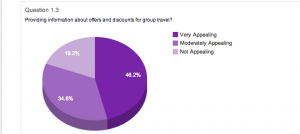

Out of those who are working professionals, 80.8% found the idea of information and offers about group travel appealing.

3. Problems with Events

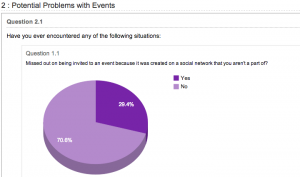

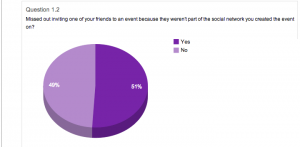

Our results suggests that our participants were much more likely to find themselves unable to invite a friend who isn’t on a social networking site to an event, than risk missing out on an event that is created on a site they aren’t a part of. With only 29.4% saying that they had missed out on an event, compared to 51% saying they’d missed out on inviting a friend to an event because they weren’t part of a social network. Koh.Tu.Me looks to address this issue by making it easy for users to invite people who aren’t part of a social network.

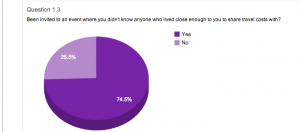

74.5% of participants answered yes to being invited to an event but not knowing who lived close enough to them to share travel costs with. Koh.Tu.Me looks to solve this with our intelligent travel algorithm that links people together based on their proximity and travel preferences.

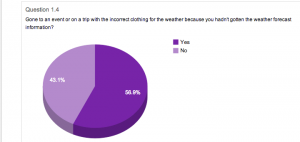

Over half of our participants also answered yes to wearing the incorrect clothing for an event based on not accessing to weather forecast information.

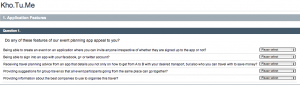

4. Application Features

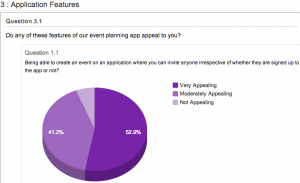

94.1% of participants said they found the idea of being able to invite people to their events irrespective of whether they are signed up to a social networking site or not appealing.

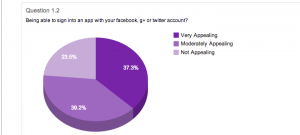

76.5% of participants said that they found the idea of being able to sign in using their facebook/twitter/google+ accounts appealing.

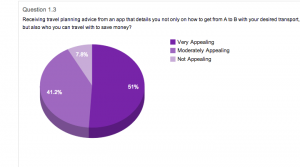

92.2% of participants said they would find receiving travel planning advice about getting from A-B using their desired transport method in addition to saving money appealing.

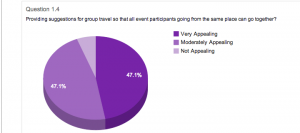

94.2% of participants said that they would find being able to travel in a group to the same place appealing.

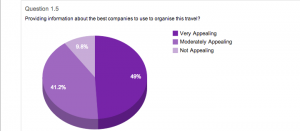

90.2% of participants said that they would find receiving information about the best companies to use to organise travel appealing.

Overall Summary of Results

|

Problem |

% Encountered |

|

Missed out on an event due to it being created on a social network you aren’t a part of. |

29.4% |

|

Missed out inviting a friend to an event as they aren’t part of the social network you created the event on. |

51.0% |

|

Being invited to an event but not knowing who lives near enough to you to share travel with. |

74.5% |

|

Gone to an event wearing the wrong clothing due to not accessing the weather forecast information. |

56.9% |

In regards to the problems Koh.Tu.Me looks to address, not knowing who to travel with to an event is clearly the most recurring problem amongst our participants.

|

Feature |

% Found Appealing |

|

Professional Features |

|

|

Professional service to organise event. |

84.6% |

|

In App Purchases. |

74.9% |

|

Offers & Information about group travelling. |

80.8% |

|

General/Social Features |

|

|

Being able to invite friends to events irrespective of whether they are on a social network or not. |

94.1% |

|

Being able to sign in with Faebook/Twitter/Google+ Accounts. |

76.5% |

|

Receiving travel planning advice about getting from A to B, and money saving advice. |

92.2% |

|

Being able to travel in a group to the same place. |

94.2% |

|

Receiving information about the best companies to use to organise travel. |

90.2% |

For professional features: these results indicate that a high proportion of the working professionals that answered this survey found these elements of Koh.Tu.Me to be appealing, with the most appealing feature being a professional service to take on more responsibility for organising the event overall. For general features: these results indicate that the most popular features center around the inclusive element of Koh.Tu.Me such as being able to invite people to an event irrespective of whether they are on a social network or not, and being able to travel together in a group to events. Encouragingly the results all showed that a much higher proportion of participants found the features of our application appealing as opposed to unappealing.

Graphs generated by: https://www.isurvey.soton.ac.uk/

Survey Design – Sami

Posted by Samantha Kanza in Interviews with Users or Focus Groups on March 27, 2014

In order to assess the viability of our application, we have created a survey.

The first part of the survey creates basic demographic information, including their age group and whether they are a working professional or not. If they answer yes to working professional, then the section underneath is shown which asks them how appealing they find potential business specific features of our application. The answers in those dropdowns are “Very Appealing”, “Moderately Appealing” and “Not Appealing”.

The second part is focused on looking at the problems kohtume is attempting to solve. So this section asks if any of our participants have encountered these problems when organising or going to events. These just require straight yes/no responses.

The third part is focused on seeing what features of our app are appealing to the participants. The answers in those dropdowns are “Very Appealing”, “Moderately Appealing” and “Not Appealing”.

Using a Qualitative Method to get Feedback on our Social Networking Application Idea – Sami & Someah

Posted by Samantha Kanza in Interviews with Users or Focus Groups on March 26, 2014

In order to see which elements of our social networking application are most appealing we decided to use a qualitative method to investigate this. We considered interviews, focus groups, and surveys as potential ways we could get this feedback and analysed the strengths and weaknesses of each method in relation to the time frame, and the information we wish to collect.

Focus Groups [1,2]

Strengths

- Exploring what different people have to say.

- Providing insights into the roots of complex behaviour and people’s motivations.

Weaknesses

- The moderator of the focus group can actually prove more disruptive than helpful when it comes to trying to draw opinions out of the participants.

- “polarization effect” – attitudes can become heightened and more extreme as the group discussion continues.

- Discussions can get sidelined if participants disagree strongly.

Surveys [3]

Strengths

- They are anonymous and neutral, potentially leading to more honesty.

- All of the data is collected automatically and can be analysed at a later date.

- Takes less time (in terms of direct time put towards the study).

- Can address lots of different demographics easily.

Weaknesses

- There’s a lack of engagement with the person answering the questions.

- There’s less scope to get more personalised information out of a survey, as whilst you can show different questions based on user answers, you can’t make subtle adaptions to the questions depending on how the answers are going.

- Takes more time (in terms of indirect time, of waiting for people to answer the questions).

Interviews [3, 4]

Strengths

- Qualitative interviews produce credible evidence

- It can be used to explore multiple different possibilities to answering a specific question, in addition to allowing for elaboration on certain points.

Weaknesses

- Interviews are neither as neutral or anonymous as surveys, meaning that people won’t necessarily answer as fully or honestly as they would in a more neutral surrounding where their answers could not be attributed back to them.

- There’s also a huge pressure to collect all the data needed during that interview period as otherwise that information could get lost or misrepresented when it comes to writing up the results.

- Can risk being interviewer led.

Conclusion

We wish to ask some very simple yes/no questions to find out if the problems that our social networking application attempts to address, are actually commonly occurring problems. We also wish to find out whether people find different elements of our social networking application appealing, and if so, how appealing. These characteristics seem to lend themselves best for a survey as we can ask direct yes/no questions and we aren’t looking for different interpretations or different ways to explore questions, we just want simple yes/no answers.

In addition we could run a survey cost free, and after the initial overhead of setting up the survey, it would take a lot less time to collect the data. It also allows us to target a wider demographic as we can share a survey with all of our Facebook friends, thus addressing people of different ages and professions.A survey also seems more likely to elicit participation as participants can fill in the survey at a time convenient to them, and we wouldn’t be asking for any personal information. Additionally, if we were to use the isurvey tool offered by soton, then that offers easy data analysis of results after the survey is completed.

Having taken all of these factors into consideration it seems like a survey is the most suitable for the questions we wish to ask, and the resources/time we have available.

References

[1]Sussman, S,. Burton, D., Dent, C.W., Stacy, A.W and Flay, B.R. Use of focus groups in developing an adolescent tobacco use cessation program: collective norm effects. J. Appl. Soc. Psychol. 1991.

[2] Morgan, D.L and Krueger, R.A. When to use Focus Groups and Why. 1993.

[3] Kvale, S. Interviews. An Introduction to Qualitative Research Interviewing. Sage Publications, Thousand Oaks, 1996.

[4] Rubin, H.J and Rubin, I.S. Qualitative Interviewing: The Art of Hearing Data. Sage Publications, 2012.

Recent Comments