Introductions: Risk Management no comments

Last week I was very excited to take a look at technoethics and found that the more I read, the more I wanted to read about it. This week, reading around the area of risk management, I have found myself in a similar situation. My mind has been buzzing with ideas about how these fields can contribute in a big way to Web science. Nonetheless, I will briefly introduce the area of risk management at this time and share these potential applications in my future posts.

Brief Overview of Risk

Defining Risk

Before talking about managing risks, it is fitting that I define risk. It has been noted that risk is defined differently from one field to the next and there is sometimes contradiction in its definition (Vaughan, 1997). This lack of agreement on definition has been partly attributed to the relatively young age of the field and practitioners adopting definitions of risk from varying fields. However, for the purposes of my adventure in the discipline, I have chosen to define risk as “an event with the ability to impact (inhibit, enhance or cause doubt about) the mission, strategy, projects, routine operations, objectives, core processes, key dependencies and or the delivery of stakeholder expectations.” (Hopkin, 2010, p. 12).

When an organisation employs the Web, it is hoped that it will lead to a favourable outcome (e.g., increased productivity) and not hurt the company (e.g., cause legal troubles) in any way. In many situations within organisations, especially when technology is involved, the result could be uncertain and this constitutes a risk. For example, as the impact of the Web could be different to what is expected, its adoption could be considered as being a control risk.

Types of Risk

There are several ways to classify types of risks and there appears to be no generally accepted classification that is right or wrong. Practitioners often adopt classifications that are appropriate for their circumstances. In addition to the control/uncertainty risks mentioned, texts usually mention two other risks: hazard/pure risks and opportunity/speculative risks. Hazard or pure risks typically refer to things like theft, health and safety risks. Opportunity or speculative risks are usually associated with financial investments, critical business decisions such as moving location or offering a new product, and also, taking or not taking the opportunity.

Not All Risks Are Equal

As you can appreciate, some situations pose a higher degree of risk than others. Situations where there is a high likelihood of a negative outcome occurring or a high probability of loss are usually considered as being riskier than situations at the other end of the spectrum. A good example of this is given by Vaughan (1997). When playing Russian roulette, there is more risk with each bullet loaded into the gun, (until obviously when the barrel is fully loaded – it’ll be certain you’re going to get shot).

Brief Overview of Risk Management

Defining Risk Management

Hubbard (2009) defined risk management as “the identification, assessment, and prioriti[s]ation of risks followed by coordinated and economical application of resources to minimi[s]e, monitor, and control the probability and/or impact of unfortunate events” (p. 10). Simply put, Hubbard believes risk management is “being smart about taking chances.” Having looked at many definitions, one consistent and important characteristic of risk management is that it is a systematic approach to dealing with risk that follows a particular process depending on the risk circumstance.

Some texts (e.g., Scarff, Carty & Charette, 1993) has found it necessary to separate the concepts of ‘management of risk’ and ‘risk management’. The latter refers to the activities of planning, controlling and monitoring, whereas the former includes such activities, as well as those associated with risk analysis.

Dealing with Risk

Risk management aims to eliminate, reduce or control risks and gain enhanced usefulness or benefits from them (Waring & Glendon, 1998). It has been suggested that successful risk management programmes feature a strategy that is:

- proportionate to the level of risk posed;

- aligned with other business activities;

- comprehensive, systematic and structured;

- embedded within business processes;

- dynamic, iterative and responsive to change.

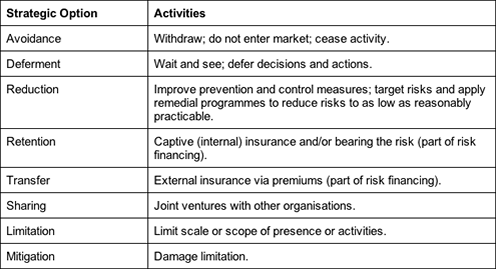

According to Waring and Glendon (1998, p. 9), risk management involves the optimal combination of the following strategic options:

Notes

This Week’s Plan

- Reading more about the methodologies associated with the selected disciplines.

- Prepare a blog post that describes the methodologies adopted by the selected disciplines and compare them.

- Explore the contributions these disciplines could make to each other and Web science.

- Publish a blog post that discusses the potential applications of these disciplines to Web science.

Last & Previous Week’s Plan

Identifying the simplest books to read that will give an easy to understand introduction to the disciplines I picked.Making notes on books read.Prepare a blog post that gives an overview of what I want to work on.Publish a blog post that introduces technoethics.Publish a blog post that introduces risk management.Outline a reading plan for moving forward.

Introductory Readings

Ethics: A Very Short Introduction– Simon BlackburnHandbook fo Research on Technoethics– Rocci Luppicini & Rebecca AdellManaging Risk: Critical Issues for Survival and Success Into the 21st Century– Alan Waring and A. Ian GlendonIntroduction to the Management of Risks– Frances Scarff, Andy Carty and Robert CharetteRisk Management– Emmett J. VaughanThe Failure of Risk Management: Why It’s Broken and How to Fix It– Douglas W. HubbardFundamentals of Risk Management Understanding, Evaluating and Implementing Effective Risk Management– Paul Hopkin